(NISBLF II)

The Northern Ireland Small Business Loan Fund (NISBLF) II is administered by our fund management company, Ulster Community Finance Ltd, on behalf of Invest Northern Ireland.

Set up to provide access to finance for small businesses, sole traders and partnerships who are keen to develop their business but may find it difficult

to access funding through traditional sources.

Our team at Ulster Community Finance Ltd, were initially awarded the

fund management contract for NISBLF I and are currently contracted to

fund manage NISBLF II.

With the loan support level now increased to £100,000 NISBLF II has the

potential to lend over £9 million to local small and medium enterprises.

NI Small Business Loan Fund II

(Revolving £5.5m loan fund managed by Ulster Community Finance Ltd on behalf of Invest Northern Ireland commenced July 2018)

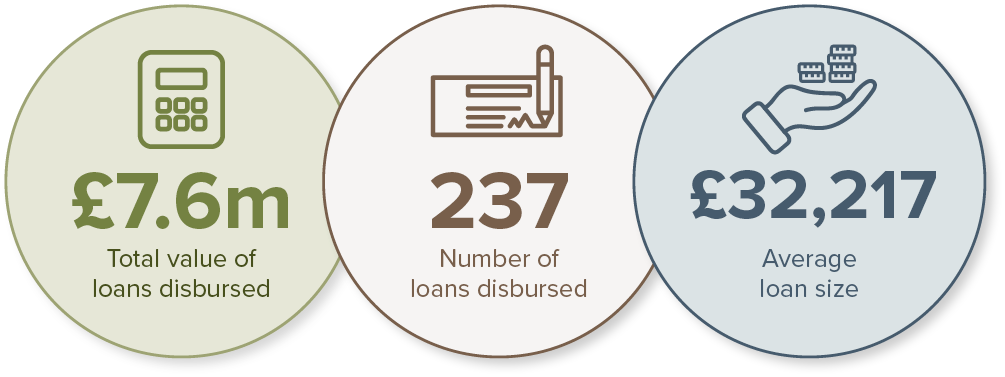

Figures to 31 December 2023:

Gorilla Karts

Gorilla Karts was founded in 2006 by Andrew Hamilton. From his premises just outside Cookstown, he sells a range of manual and electronic scooters, go-karts, hoverboards and accessories. Gorilla Karts secured £75,000 funding from NISBLF to meet growing customer demand for products and the company’s repair service.

Growing public interest in e-scooters and hoverboards over the past two years, has resulted in a huge increase in sales. The funding Gorilla Karts received from the Northern Ireland Business Loan Fund has allowed us to purchase additional stock in time for the Christmas rush and to recruit technical repair staff. As well as our local customer base, we also sell online at eBay and Amazon so the funding and valuable advice provided by Ulster Community Finance meant we could maintain our stock levels to meet customer demand.

Andrew Hamilton

Founder, Gorilla Karts